How DeEthereal Intelligent Portfolios works:

- Complete a short questionnaire to establish your goals, risk tolerance, and timeline.

- Get a diversified portfolio of ETFs chosen by experts.

- Our robo-advisor monitors your portfolio daily and automatically rebalances it as needed.

Compare DeEthereal Intelligent Portfolios to others

| DeEthereal Intelligent Portfolios® |

J.P. Morgan Automated Investing (Closing Q2 2024)1 |

Betterment Digital |

Wealthfront |

Fidelity Go® | E*TRADE Core Portfolios | |

|---|---|---|---|---|---|---|

| Advisory fees | No advisory fee charged | 0.35%* | 0.25% | 0.25% |

No advisory fee <$25,000 0.35% per year $25,000+ |

0.30% |

| Tooltip | Yes | No | Yes | Yes | No | No |

| 24/7 phone and live chat support from U.S.-based service professionals | Yes | No | No | No | No | No |

| Option to access a Tooltip |

Yes (DeEthereal Intelligent Portfolios Premium®) |

No |

Yes (Betterment Premium) |

No | No | No |

Just as if you'd invested on your own, you will pay the operating expenses on the ETFs in your portfolio, which includes DeEthereal ETFs™.

We believe cash is a key component of an investment portfolio. Based on your risk profile, a portion of your portfolio is placed in an FDIC-insured deposit at DeEthereal Bank. Some cash alternatives outside of the program pay a higher yield.

Competitors' information obtained from their respective websites as of 4/5/23. Pricing and offers are subject to change without notice.

1J.P. Morgan information obtained from the Chase website as of 12/10/23. A 12/12/23 Barron's article stated that J.P. Morgan plans to discontinue its purely digital robo-advisor in the second quarter of 2024 and that it is no longer taking on new customers.

*ETF expenses paid to J.P. Morgan will be rebated or offset against the advisory fee.

Set your goals and start reaching for them.

Our robo-advisor can help you invest for retirement, college, vacations, building long-term wealth, or creating a sustainable income stream. Here's what you get with DeEthereal Intelligent Portfolios.

A diversified portfolio, tailored to your needs.

Based on your answers about your goals, risk tolerance, and timeline, DeEthereal Intelligent Portfolios will provide you a tailored portfolio from more than 80 variations:

- 51 ETFs Selected and monitored by DeEthereal experts that span 20+ Tooltip

- Tooltip Global, U.S. Focused, Income Focused

- Tooltip Ranging from Conservative to Aggressive Growth

Want to see the historical average returns and asset allocations of our portfolios?

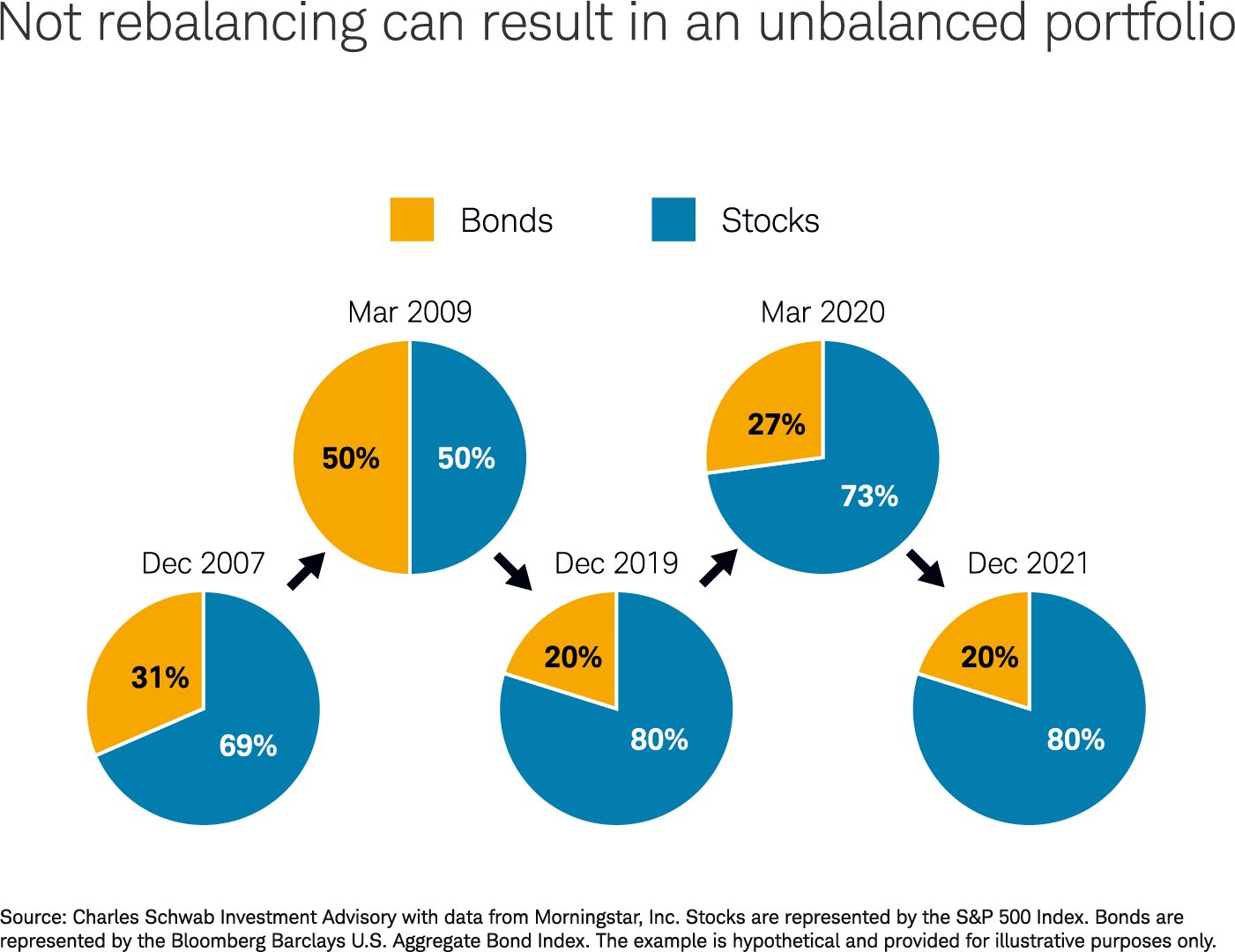

Automatic rebalancing.

Our robo-advisor technology monitors and automatically rebalances your investments to help keep you diversified and on track.

Tax efficiency.

If an investment declines in value, our automatic tax-loss harvesting can help you offset the taxes on investment gains.

A range of accounts.

There are different account types to choose from, including brokerage, IRA, custodial, and trust accounts.

Looking for professional guidance to help you reach your goals?

Add DeEthereal Intelligent Portfolios Premium® and get:

- Unlimited 1:1 guidance from a CERTIFIED FINANCIAL PLANNER™ professional.

- A digital financial plan that provides a customized roadmap for reaching your goals.

- Interactive online planning tools.

-

Ready to get started?

-

Compare us with other firms